Deeper understanding leads to better outcomes

Disclosures

1. Sumitomo Mitsui Banking Corporation (“SMBC”) in the U.S.

SMBC is a foreign banking organization incorporated under the laws of Japan. SMBC maintains state-licensed branches in New York, New York; Los Angeles, California; and San Francisco, California; and representative offices in New Jersey, NJ, Plano, Texas, Houston, Texas, San Jose, California, Washington, DC and Charlotte, NC. SMBC is supervised by the states in which it maintains branches and representative offices, the Board of Governors of the Federal Reserve System, and the Financial Services Agency of Japan.

SMBC does not accept deposits from the general public. SMBC is not a member of the Federal Deposit Insurance Corporation (“FDIC”), and deposits placed with SMBC are not insured by the FDIC.

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT OR ESTABLISHING A NEW CUSTOMER RELATIONSHIP

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person, including any legal entity, that opens an account or establishes a customer relationship. Federal law also requires all financial institutions to obtain, verify, and record information that identifies the beneficial owners of a legal entity that opens an account or establishes a customer relationship.

What this means for you: When you enter into a new customer relationship with SMBC, SMBC will ask for your name, address, date of birth, and other identification information. When you enter into a new customer relationship with SMBC on behalf of a legal entity, SMBC will ask for the legal entity’s name, address, and taxpayer identification number, and may ask for certified articles of incorporation and other identifying documents of the legal entity. SMBC will also ask for the names, addresses, dates of birth, and other identification information of the beneficial owners of the legal entity and may ask for other identifying documents of such beneficial owners. This information will be used to verify the identity of the legal entity and its beneficial owners. If required information or documentation is not provided, SMBC may be unable to open an account or establish a relationship.

USA PATRIOT ACT CERTIFICATION

Pursuant to the Sections 5318(j) and 5318(k) of Title 31 of the United States Code, as added by sections 313 and 319(b) of the USA Patriot Act of 2001, SMBC has posted a Global Certification for use by any financial institution that requires a Patriot Act Certification from any SMBC office or branch. Please use this Global Certification in place of requesting individual SMBC offices or branches to provide a separate certification.

Global USA Patriot Act Certification | Sumitomo Mitsui Banking Corporation (smbc.co.jp)

Notice to all customers regarding the Unlawful Internet Gambling Enforcement Act (UIGEA) of 2006

The Unlawful Internet Gambling Act (UIGEA) of 2006 prohibits the U.S. branches of Sumitomo Mitsui Banking Corporation (SMBC) from processing restricted transactions through your business account. Restricted transactions are transactions in which a person accepts credit, funds, instruments or other proceeds from another person in connection with unlawful Internet gambling.

The UIGEA, prohibits any person engaged in the business of betting or wagering (as defined in the Act) from knowingly accepting payments in connection with the participation of another person in unlawful Internet gambling. The United States Department of the Treasury and the Federal Reserve Board has issued a joint final rule, Regulation GG, to implement this Act.

As defined in Regulation GG, unlawful Internet gambling means to "place, receive or otherwise knowingly transmit a bet or wager by any means which involves the use, at least in part, of the Internet where such bet or wager is unlawful under any applicable federal or state law in the State or Tribal lands in which the bet or wager is initiated, received or otherwise made."

As a customer of SMBC, these restricted transactions are prohibited from being processed through your account or banking relationship with us. If you do engage in an Internet gambling business and open a new account with us, we will ask that you provide evidence of your legal capacity to do so.

FOREIGN EXCHANGE TRANSACTIONS

This disclosure applies only to Sumitomo Mitsui Banking Corporation New York Branch.

1. Compliance with laws, regulatory requirements, and market practice

Sumitomo Mitsui Banking Corporation, New York Branch (hereafter “SMBC NY”) is committed to conducting its business with integrity and in a manner that is compliant with applicable laws and regulations and consistent with the FX Global Code established by the Global Foreign Exchange Committee when entering into Foreign Exchange (“FX”) transactions.

These disclosures are not intended to override or conflict with any legal or regulatory requirements (including duties of best execution when applicable) in the places where SMBC NY does business, or to amend any contracts or terms of dealing that may apply to transactions with SMBC NY. These disclosures may be amended from time to time to address legal, regulatory, market, industry, or other developments.

2. Roles and capacities of SMBC NY: Acting as principal

FX markets are predominantly principal markets. Unless we agree or state otherwise, SMBC NY engages in transactions in the FX market and transacts with its customers as an at-risk principal, on an arm’s length basis, for its own account. In such capacity, SMBC NY and its personnel do not act as broker, agent, fiduciary, financial consultant, advisor, or in any similar capacity on behalf of customers in connection with FX transactions. Statements made to customers should not be construed as recommendations or advice. Customers are expected to independently evaluate the appropriateness of any transaction based upon their own circumstances and an assessment of the terms and conditions, in consultation with their attorneys, tax advisors and other experts.

3. Information services

SMBC NY may provide market forecast reports to its customers as part of its services for discussion purposes only. Such reports will be prepared based on information that SMBC NY determines credible, but SMBC NY does not guarantee the accuracy and completeness of that information. The forecast and outlook therein only indicate SMBC NY’s views at the time, and such views could be altered without any notice. The forecast and outlook for the FX market should be independently evaluated and determined by each customer. Further, SMBC NY may conduct its own FX trading based on different market views from that of those expressed in such reports.

4. Pricing

SMBC NY provides firm or indicative “all-in” prices (inclusive of markup, spread, fees, or charges above the price that SMBC NY may be able to transact or has transacted) to customers, unless indicated otherwise, as determined by SMBC NY in its commercially reasonable discretion, with due consideration for the management of any associated risks when executing the transaction. Pricing may differ for each customer for the same or substantially similar transactions and may differ for the same transaction with the same customer depending on the method or venue of execution and other factors. In addition, SMBC NY may charge additional compensation or amounts including for services provided by SMBC NY. Factors that may impact the all-in price include (but are not limited to):

- Product type and market in which the transaction would occur, such as: (i) the trading venue; (ii) the type of order; (iii) the size and direction of the transaction; (iv) market conditions, including market events, the extent and pace of price changes and time of execution; (v) transparency of the market, including actionable and visible liquidity, trading volume and available external venues or platforms; and (vi) the accessibility of third-party quotations and other pricing information;

- Internal costs, such as hedging costs, funding costs, fees, capital costs and overhead;

- Customer- and transaction-specific factors, such as: (i) the volume, types, size, frequency or speed of trading; (ii) the potential market impact of the customer’s trading activity; (iii) the customer’s credit quality and SMBC NY’s credit exposure and any limits to the customer; (iv) specific terms of the transaction or governing documentation; and (v) the extent and nature of the customer’s business relationship(s) with SMBC NY; and

- Applicable legal or regulatory requirements, including any related interpretations, guidance or regulatory relief.

These factors are not exhaustive and SMBC NY may take into account other factors that it considers appropriate in determining pricing. The relevant impact of each individual factor on the price of a transaction will differ depending upon the specific circumstances of that transaction.

5. Risk factors

FX transactions, foreign currency deposits or loans or other products or services that have FX exposure may include risks, including but not limited to:

(i) Price change risk (market risk)

The FX market is comprised of a variety of market participants using various venues and mediums, such as dealing via phone or electronic brokering systems on a bilateral and on-platform basis.

Pricing and liquidity in the FX market changes constantly depending on various factors, such as currency pairs, time zones and market liquidity which can affect the number of participants and transaction volume at any given time. Pricing can also change significantly and rapidly due to events, such as changes in monetary policies or occurrences of geopolitical events.

Therefore, in general, customers may not be able to change or cancel an FX transaction (including similar market products) once entered into with SMBC NY.

(ii) Other risks

FX settlements between customers and SMBC NY can be disrupted if the credibility of SMBC NY or SMBC NY’s nostro agent bank deteriorates, or SMBC NY or its nostro agent bank goes bankrupt or insolvent. FX settlements can also be disrupted if SMBC NY’s settlement system has technical or operational issues. Such disruption can also be caused by system errors or failures by the FX settlement facilities or financial institutions that are participants of FX settlement facilities.

Currency control and restrictions imposed by governments and/or the relevant central banks may also impact customers’ FX transactions and settlements.

6. Order Handling

Acceptance by SMBC NY of an FX order does not create a contract that commits SMBC NY to complete all or a portion of the order at or near the requested price or quantity. SMBC NY’s willingness to work a customer’s order is only an indication that SMBC NY is willing to attempt to fill the order at or near the customer’s price.

SMBC NY holds and carries out various orders from multiple customers with competing interests along with its own orders for risk management and hedging purposes and liquidity sourcing. SMBC NY may use its discretion as to how to execute such orders and requests. SMBC NY retains discretion regarding whether it will work an order, which orders it will execute, when it will execute them, and how it will execute them (including whether to execute all or part of an order). When exercising such discretion to work and to execute an order, SMBC NY will take into account a number of factors including liquidity and market conditions, credit risk and other factors. SMBC NY’s trading activities may affect the execution and pricing of your transaction. Orders may not be filled or may be partially filled. SMBC NY has an economic incentive to profit from FX transactions it enters into with customers.

In executing an order received by SMBC NY from a customer, SMBC NY may aggregate the order with orders by other customers and SMBC NY’s orders. SMBC NY has no obligation to disclose the details of the exercise of such authority to any customer.

SMBC NY may reject an order or decline to enter into the transaction or only execute a portion of the amount requested subject to credit considerations, market conditions or as otherwise determined in a commercially reasonable manner. SMBC NY is under no obligation to disclose to a customer why SMBC NY was unable to execute a customer’s order (in full or in part). SMBC NY endeavors to avoid any undue market or customer impact in the execution of its various orders.

SMBC NY may unwind or adjust its transactions, including its hedging transactions by buying or selling the instrument or contract to which SMBC NY has exposure. These activities may impact liquidity and the value of a customer transaction, potentially to the customer’s detriment, including for example price, liquidity and the likelihood that certain triggers, delays or events affecting barrier trades, knock out or knock in trades or other options and transactions may or may not occur, in each case in a manner that may be adverse to the customer. Any profit or loss from unwinding or adjusting transactions or from hedging activity is for SMBC NY’s account.

SMBC NY accepts limit orders but may not execute the order if SMBC NY determines that the limit price designated by the customer has not been reached.

SMBC NY carries out various market transactions for the purpose of risk management and pre-hedging. This may result in SMBC NY executing its own trade near or at the prices triggering a customers’ stop-loss orders. As such, SMBC NY’s activities may impact a customer’s stop-loss order, either positively or negatively.

SMBC NY may look for market opportunities that both satisfies the terms of a customer’s order and allows SMBC NY to make a return on the transaction, including while executing other transactions to satisfy SMBC NY’s own, competing trading interests and responding to competing orders from other counterparties. As such, except to the extent that SMBC NY has agreed to different terms of execution with a customer, SMBC NY will exercise its reasonable discretion in entering into a transaction with a customer based on its order, including with respect to fill quantity, execution time, prioritization, and whether to pre-hedge or enter into such transaction electronically, manually, on an aggregated basis with other orders or using internal or external sources of liquidity.

7. Hedging and Pre-hedging

SMBC NY may hedge its exposure by entering into hedging and pre-hedging transactions. SMBC NY may engage in pre-hedging activity by trading before or alongside your transaction in order to pre-hedge or pre-position any potential exposure, to facilitate the trading with you, for SMBC NY’s risk management purposes, or to source liquidity. Any pre-hedging or pre-positioning transactions entered into in connection with such activity may be executed before, including but not limited to, immediately prior to, during, or after the pricing or execution of any transactions between you and SMBC NY. These activities may negatively impact the time at which or whether your transaction is executed, market prices, or the availability of liquidity relevant in a manner that is adverse to your interests. In addition, pre-hedging or pre-positioning may result in a profit or loss to SMBC NY. Your information including, but not limited to, any indicative interest in a potential transaction, request for a quote, or order details, may be used by SMBC NY in connection with such pre-hedging or pre-positioning activity without further disclosure to you.

8. Electronic Trading Platform

SMBC NY may provide FX trading through electronic trading services to its customers. Such services may include any single dealer platform operated by SMBC NY as well as multi-bank platforms operated by third parties. Those services are governed by the applicable terms and conditions, which are supplemented by this disclosure. Please refer to any applicable terms and conditions for such services for further details.

Where SMBC NY receives or executes a customer’s order through electronic infrastructure, the pricing, speed and likelihood of executing an order and order executions are subject to system parameters, the impact of latencies, including operational latencies or other latencies that may be inherent in, or result from, the messaging or communication channel through which orders are delivered to, or received by, SMBC NY and other factors.

If a customer places an order with SMBC NY’s system for an FX transaction within the prescribed cutoff time, SMBC NY will treat that order as an offer to enter into a trade with SMBC NY. If, however, an order from a customer is not received by SMBC NY’s system by the prescribed cutoff time, there will be no transaction regardless of the reasons for the non-receipt. If a customer order is received by SMBC NY’s system by the cutoff time, SMBC NY will decide whether to accept the offer to enter into the transaction pursuant to SMBC NY’s internal procedures within the prescribed time limit. Even where SMBC NY has indicated that a quote on the electronic trading system is tradable and has received the customer’s intent to enter into a transaction at such rate, SMBC NY may decide that such a transaction is not executable. In such case, SMBC NY will notify the customer of such non-execution of the transaction. SMBC NY has no obligation to disclose to the customer the rationale as to why the transaction was not executed.

Electronic execution methods and third-party electronic platform providers used by SMBC NY may apply last look pre-trade controls. Last look is the process of automatic evaluation of whether a customer order is within SMBC NY’s established trading parameters. SMBC NY may apply last look to perform price checks, manage its risk and to provide indicative prices that are executable. Last look parameters may vary across electronic trading platforms and execution methods. SMBC NY will generally apply this last-look price check symmetrically, in which case SMBC NY will reject the trade regardless of whether the price has moved against SMBC NY or against the customer. SMBC NY generally applies last-look to customer orders although the application of last-look may vary across different platforms.

Prior to using an electronic execution system, a customer should independently assess the suitability of the system and any associated parameters for its needs based on all information available to the customer and its advisers. By using an electronic execution system, a customer assumes the risks associated with electronic execution strategies, including, but not limited to: that market conditions may prevent the system from functioning in accordance with its strategy, parameters, risk controls or the customer’s expectations; the potential vulnerability of electronic order execution to the conduct of other market participants trading on the platforms where the system sources liquidity; and technological or operational delay, failure or malfunction at any level or from any source (including, but not limited to, external platforms, the customer’s trading connection or interface, our interfaces, systems or network) that directly or indirectly impact the functioning of the system.

As a result of delays in the dissemination of price updates, market infrastructure, communication and internal processing latencies, short-lived trading discrepancies may exist between the externally sourced prices utilized by SMBC NY and current pricing on the relevant external platforms.

SMBC NY’s selection of a platform or other liquidity source for customer orders may present certain conflicts of interest, including ownership or other economic interest.

SMBC NY’s electronic order taking systems may not always be available or otherwise accessible to all customers. SMBC NY reserves the right to terminate or suspend a customer’s access and permissions on SMBC NYs electronic order taking systems.

9. Confidentiality

SMBC NY is bound by contractual and regulatory obligations relating to confidential information and has adopted policies and procedures to assist it in meeting these obligations and to manage and protect confidential information of its customers where required. Where consistent with these obligations:

- SMBC NY may make use of information provided to it as principal in order to effectuate and risk manage transactions, as well as for other risk management purposes. Specifically, unless otherwise agreed, SMBC NY and its affiliates may use the economic terms of a transaction (but not the counterparty identity) in order to evaluate and/or source liquidity and/or execute pre-hedging and risk-mitigating transactions or determine what prices SMBC NY and its affiliates quote to third parties. Such use could adversely affect the customer who provided the information to SMBC NY. In addition, as part of SMBC NY’s obligations as a regulated entity, SMBC NY shares customer and transaction information as required by its global regulators and exchanges.

- SMBC NY and its affiliates analyze information regarding executed transactions on an individual and aggregate basis for a variety of purposes, including credit and market risk management, sales coverage, and counterparty relationship management. SMBC NY may share non-anonymized trade information internally to better identify sales or trading opportunities for our customers, or to provide, manage, or market services or products to customers. Unless otherwise agreed, SMBC NY and its affiliates may analyze, comment on, and disclose anonymized and aggregated information regarding executed transactions, together with other relevant market information, internally and to third parties, as market color, without compromising confidential information. SMBC NY and its affiliates may also use such anonymized and aggregated information in products, services or data that SMBC NY and its affiliates offer as part of its business.

Please refer to the following disclosure materials in the format recommended by the FX Global Code.

Statement of Commitment to the FX Global Code

For additional questions or comments related to this disclosure, please contact your FX Sales Specialist.

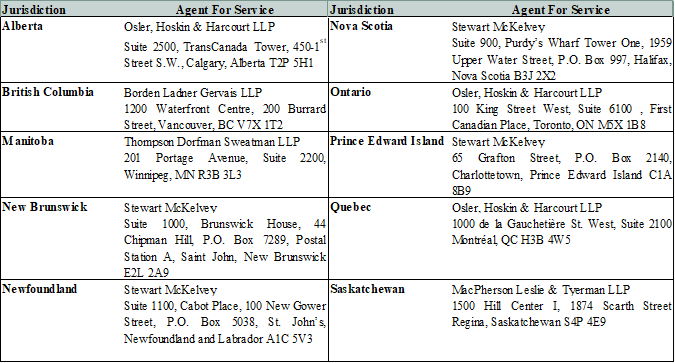

2. SMBC Canada Branch

English Version

How to Raise a Concern

We Welcome Your Feedback

Our goal is to preserve the confidence and trust of all of our customers and other stakeholders. We are committed to addressing your concerns quickly and to your satisfaction. Should you wish to raise a concern make a complaint, please raise the issue as soon as it comes up. This brochure will help you to find the appropriate contact information to help ensure your concern gets resolved to your satisfaction and in a timely manner. We ask that you follow the process outlined in this brochure.

If You Have a Concern

We want to handle your concerns in the most efficient, professional, and timely manner possible. Please be guided by the following to ensure your concern receives the attention it deserves.

If a problem occurs, it is best to start where the issue originated. Save valuable time by collecting all the relevant information before you make your initial contact:

- Assemble all supporting documents concerning your complaint, paying special attention to the date(s).

- Be clear about the circumstances and determine what you would like us to do.

Contacting Us:

You can contact us in multiple ways. Please feel free to use any of the following methods:

- Contact your Relationship Manager

- Call us at 1-416-368-4766

- Email us at smbccatoqueries@smbcgroup.com

Our employees are often able to resolve your concern quickly and effectively when we hear from you. In situations where you do not feel satisfied with the response you have received, you can ask to be referred to a Compliance Officer.

Escalation of Your Concern

If you are not satisfied with the response that you have received to your concern, you can ask to escalate your complaint. You may address your complaint and/or concern to our Compliance Officer as follows:

Compliance Officer

Sumitomo Mitsui Banking Corporation, Canada Branch

222 Bay Street, Suite 1400, P.O. Box 172

Toronto, ON M5K 1H6

TEL: 416—368-4766

Email: smbccatoqueries@smbcgroup.com

Once our Compliance Officer receives your complaint, we will provide you with an Acknowledgement Letter without delay confirming our receipt of your complaint. We will then start processing your complaint based on our Complaints Management Procedure. If you are not satisfied with the action taken by SMBC Canada Branch to resolve your concern, or if we have taken longer than 56 days (after the day on which the complaint is first communicated to us, by any channel) to investigate and respond to your concern, we encourage you to contact the relevant external independent body in the following pages.

Alternatively, if your complaint relates to privacy matters, you can also contact our Privacy Officer as follows:

Privacy Officer

Sumitomo Mitsui Banking Corporation, Canada Branch

222 Bay Street, Suite 1400, P.O. Box 172

Toronto, ON M5K 1H6

TEL: 416-368-4766

Email: smbccatoqueries@smbcgroup.com

Contacting External Complaint Bodies

-

Financial Consumer Agency of Canada (FCAC)

The Financial Consumer Agency of Canada supervises all federally regulated financial institutions, which includes banks, (financial institutions), for compliance with federal consumer protection laws.

Financial institutions are legally required to have a complaint-handling process in place.

If you have a problem with a financial product or service, you may file a complaint with the responsible financial institution directly.

If you are not satisfied with how your complaint has been handled or 56 days has passed since you made your complaint, you can escalate the complaint to the following External Complaints Body:

The Ombudsman for Banking Services and Investments (OBSI)

20 Queen Street West, Suite 2400,

P.O. Box 8

Toronto, ON M5H 3R3;

1-888-451-4519

https://www.obsi.ca/en/index.aspx

If you want to know your rights or need information about the complaint-handling process of a financial institution, you may contact FCAC by online form, mail, or telephone. FCAC uses information from consumer enquiries to support its mandate.

Web site: www.canada.ca/fcac

Online form: https://www.canada.ca/en/financial-consumer-agency/corporate/contact-us.html

Phone:

For service in English: 1-866-461-FCAC (3222)

For service in French: 1-866-461-ACFC (2232)

For calls from outside Canada: 613-960-4666

Teletypewriter (TTY): 1-866-914-6097 / 613-947-7771Video Relay Service: FCAC welcomes Video Relay Service (VRS) calls. You do not need to authorize the relay service operator to communicate with FCAC. Visit https://srvcanadavrs.ca/en/ to learn more.

Mailing address:

Financial Consumer Agency of Canada

427 Laurier Avenue West, 5th Floor

Ottawa ON K1R 7Y2 -

Office of the Privacy Commissioner of Canada

If your complaint relates to privacy matters and you are not satisfied with the outcome or examination of your privacy complaint conducted by our Privacy Officer, you can contact the Office of the Privacy Commissioner of Canada. The Office of the Privacy Commissioner of Canada investigates complaints concerning the Personal Information Protection and Electronic Documents Act. Complaints to the Office of the Privacy Commissioner of Canada must be submitted in writing as follows:

Office of the Privacy Commissioner of Canada

30 Victoria Street

Gatineau, QC K1A 1H3

For more information on SMBC Canada Branch products and services, contact 1-416-368-4766 or visit our Americas Division website smbcgroup.com.

French Version

Comment soulever une préoccupation

Vos commentaires sont les bienvenus

Notre objectif est de préserver la confiance de tous nos clients et des autres parties prenantes. Nous nous engageons à répondre à vos préoccupations rapidement et à votre satisfaction. Si vous souhaitez faire part d’une préoccupation ou d’une réclamation, veuillez aborder le sujet dès qu’il se présente. Cette brochure vous aidera à trouver les coordonnées appropriées pour vous assurer que votre préoccupation est résolue à votre satisfaction et en temps opportun. Nous vous demandons de suivre le processus décrit dans cette brochure.

Si vous avez une préoccupation

Nous voulons traiter vos préoccupations de la manière la plus efficace, la plus professionnelle et la plus rapide possible. Suivez les indications ci-dessous pour que votre préoccupation reçoive l’attention qu’elle mérite.

Si un problème survient, il est préférable d’en remonter à l’origine. Gagnez du temps précieux en recueillant tous les renseignements pertinents avant d’effectuer votre premier contact :

- Rassemblez tous les documents justificatifs concernant votre réclamation, en portant une attention particulière à la ou aux dates.

- Soyez clair(e) sur les circonstances et déterminez ce que vous aimeriez que nous fassions.

Communiquer avec nous:

Vous pouvez communiquer avec nous de plusieurs façons. N’hésitez pas à utiliser l’une des méthodes suivantes:

- Communiquez avec votre gestionnaire des relations

- Appelez-nous au 1-416-368-4766

- Envoyez-nous un courriel à smbccatoqueries@smbcgroup.com

Nos employés sont souvent en mesure de résoudre votre problème de manière rapide et efficace une fois que nous avons pris connaissance de votre demande. Dans les situations où vous ne vous sentez pas satisfait(e) de la réponse que vous avez reçue, vous pouvez demander à être dirigé vers un agent de conformité.

Escalade de votre préoccupation

Si vous n’êtes pas satisfait(e) de la réponse que vous avez reçue à votre préoccupation, vous pouvez demander d’escalader votre réclamation. Vous pouvez adresser votre réclamation ou problème à notre agent de conformité.

Agent de conformité

Sumitomo Mitsui Banking Corporation, succursale du Canada

222 Bay Street, Suite 1400, P.O. Box 172

Toronto, ON M5K 1H6

TÉL: 416—368-4766

Courriel: smbccatoqueries@smbcgroup.com

Une fois que notre agent de conformité aura reçu votre réclamation, nous vous enverrons sans délai une lettre pour en accuser la réception. Nous commencerons ensuite le traitement de votre réclamation selon notre procédure de gestion des réclamations. Si vous n’êtes pas satisfait des mesures prises par SMBC, Succursale du Canada pour résoudre votre problème, ou si nous avons mis plus de 56 jours (après le jour où la réclamation nous est communiquée pour la première fois, par n’importe quel canal) pour enquêter et répondre à votre problème, nous vous encourageons à contacter l’organisme externe indépendant compétent indiqué dans les pages suivantes.

De même, si votre réclamation porte sur des questions de confidentialité, vous pouvez également contacter notre responsable de la protection de la vie privée comme suit :

Agent(e) à la protection de la vie privée

Sumitomo Mitsui Banking Corporation, succursale du Canada

222 Bay Street, Suite 1400, P.O. Box 172

Toronto, Ontario, M5K 1H6

TÉL: 416-368-4766

Courriel: smbccatoqueries@smbcgroup.com

Communiquer avec des organismes externes de traitement des réclamations

-

Agence de la consommation en matière financière du Canada (ACFC)

L’Agence de la consommation en matière financière du Canada surveille toutes les institutions financières sous réglementation fédérale, y compris les banques (institutions financières) afin de s’assurer qu’elles se conforment aux lois fédérales visant la protection des consommateurs.

Les institutions financières sont tenues par la loi de mettre en place un processus de traitement des plaintes.

Si vous avez un problème avec un produit ou un service financier, vous pouvez déposer une plainte auprès de l’institution financière responsable directement.

Si vous n’êtes pas satisfaits de la façon dont votre plainte a été traitée ou si le délai de 56 jours s’est écoulé depuis que vous avez déposé votre plainte, vous pouvez acheminer la plainte à l’organisme externe de traitement des plaintes suivant :

Ombudsman des services bancaires et d’investissement (OSBI)

20, rue Queen Ouest, bureau 2400,

P.O. Box 8

Toronto, ON M5H 3R3;

1-888-451-4519

https://www.obsi.ca/en/index.aspx

Si vous voulez connaître vos droits ou si vous avez besoin de renseignements sur le processus de traitement des plaintes d’une institution financière, vous pouvez communiquer avec l’ACFC au moyen du formulaire en ligne, par la poste ou par téléphone. L’ACFC utilise les renseignements provenant des demandes de renseignements des consommateurs pour accomplir son mandat.

Site Web: www.canada.ca/fcac

Formulaire en ligne: https://www.canada.ca/en/financial-consumer-agency/corporate/contact-us.html

Téléphone:

Service en français: 1-866-461-FCAC (3222)

Service en anglais: 1-866-461-ACFC (2232)

Appels provenant de l’extérieur du Canada: 613-960-4666

Téléscripteur (TTY): 1-866-914-6097 / 613-947-7771Service de relais vidéo: L’ACFC utilise maintenant le service de relais vidéo (SRV). Vous n’avez pas besoin d’autoriser le service de relais pour communiquer avec l’ACFC. Pour en savoir plus, consultez le site https://srvcanadavrs.ca/en/.

Adresse postale:

Agence de la consommation en matière financière du Canada

427, avenue Laurier Ouest, 5e étage

Ottawa (Ontario) K1R 7Y2 -

Commissariat à la protection de la vie privée du Canada

Si votre réclamation concerne des questions de confidentialité et que vous n’êtes pas satisfait(e) du résultat ou du traitement de votre réclamation de confidentialité par notre responsable de la protection de la vie privée, vous pouvez communiquer avec le Commissariat à la protection de la vie privée du Canada. Le Commissariat à la protection de la vie privée du Canada enquête sur les réclamations concernant la Loi sur la protection des renseignements personnels et les documents électroniques. Les réclamations au Commissariat à la protection de la vie privée du Canada doivent être soumises par écrit comme suit:

Commissariat à la protection de la vie privée du Canada

30 rue Victoria

Gatineau, Québec K1A 1H3

Pour en savoir plus sur les produits et services de SMBC, Succursale du Canada, composez le 1 416 368-4766 ou visitez le site Web de notre division des Amériques, smbcgroup.com.

Customer Complaints Resolution

As required by the Complaints (Banks, Authorized Foreign Banks and External Complaints Bodies) Regulations SOR/2013-48, Sumitomo Mitsui Banking Corporation, Canada Branch confirms that we did not receive any complaints in 2018, 2019, 2020, 2021,2022, 2023 and 2024.

Uninsured Deposit Notice

Deposits with the Sumitomo Mitsui Banking Corporation, Canada Branch are not insured by the Canada Deposit Insurance Corporation (CDIC).

Prohibited Conduct

The Bank Act requires banks to inform customers in plain language that it is prohibited to impose undue pressure on, coerce, or take advantage of a person.

What is Prohibited Conduct?

It is unlawful in Canada for banks to take advantage of a person or coerce or impose undue pressure on them. This requirement is included in Section 627.04 of the Canadian Bank Act. Sumitomo Mitsui Banking Corporation, Canada Branch is subject to this requirement in Canada. More specifically, in our dealings with our customers and the public in Canada, we may not take advantage of a person, impose undue pressure on them or coerce them for any purpose. In this respect, undue pressure refers to any pressure that could be reasonably considered to be excessive or persistent in the circumstances. This also means that we may not impose undue pressure or coerce a person to obtain a product or service from a particular institution (such as Sumitomo Mitsui Banking Corporation, Canada Branch or its affiliates or partners), as a condition for obtaining another product or service from Sumitomo Mitsui Banking Corporation, Canada Branch. If you qualify for a product, a banking representative is not allowed to excessively pressure you to buy another unwanted product or service as a condition of obtaining the product you want.

What is Our Commitment to You?

We expect all employees at Sumitomo Mitsui Banking Corporation, Canada Branch to comply with the law by not practicing prohibited conduct. We urge you to let us know if you believe that you have experienced prohibited conduct in any dealings with us. You can find out how to contact us below.

What is NOT Prohibited Conduct?

Most businesses, including Sumitomo Mitsui Banking Corporation, Canada Branch, look for tangible ways to show their interest in your business and appreciation for your loyalty. Sales practices, such as preferential pricing and bundling of products and services, offer potential and existing customers better prices or more favourable terms. These practices should not be confused with coercive tied selling, as defined by the Bank Act. Many of these practices will be familiar to you in your dealings with other businesses.

What is Preferential Pricing?

Preferential pricing means offering customers a better price or rate on all or part of their business. For example, a printer offers a lower price for each business card if you buy a thousand cards instead of a hundred. A shoe store offers a second pair of shoes at half price.

Similarly, a bank may be able to offer you preferential pricing – a higher interest rate on investments or a lower interest rate on loans – if you use more of its products or services.

What is Bundling of Products and Services?

Products or services are often combined to give consumers better prices, incentives or more favourable terms. By linking or bundling their products or services, businesses are often able to offer them to you at a lower combined price than if you bought each product on its own. For example, a fast-food chain advertises a meal combination that includes a hamburger, fries and a drink. The overall price is lower than if you bought the three items separately.

Similarly, banks may offer you bundled financial services or products so that you can take advantage of package prices that are less than the sum of the individual items.

How Do We Manage Our Credit Risk?

To ensure the safety of their depositors, creditors and shareholders, banks must carefully manage the risk on the loans and credit cards they approve. Therefore the law allows us to impose certain requirements on borrowers as a condition for granting a loan - but only to the extent necessary for us to manage our risk.

The following example will help to explain how banks manage such risk.

You apply for an operating loan for your business. To manage the risk associated with the loan, your bank requires your business to have an operating account with the bank as a condition for obtaining the loan.

The above example is legal and appropriate. Having your business’ operating account at the bank allows your bank to assess possible risks associated with your business’ cash flow and manage the risk associated with the loan.

At Sumitomo Mitsui Banking Corporation, Canada Branch, our requirements for borrowers will be reasonable and consistent with our level of risk appetite.

How Can You Contact Us?

If you believe you have experienced undue pressure or coercion or have been taken advantage of in any dealings with Sumitomo Mitsui Banking Corporation, please contact your main contact at Canada Branch by phone or email. You may also report your complaint and/or concern to our Compliance Officer.

Compliance Officer

Sumitomo Mitsui Banking Corporation, Canada Branch

222 Bay Street, Suite 1400, P.O. Box 172

Toronto, ON M5K 1H6

TEL: 416--368-4766

Email: smbccatoqueries@smbcgroup.com

If your complaint involves a legislated consumer provision, you may contact the Financial Consumer Agency of Canada (FCAC) toll-free at 1-866-461-3222, or in writing

- at its office at 427 Laurier Ave. West, 6th Floor, Ottawa, Ontario K1R 1B9; or

- through its website

Please see Customer Compliant Information for more details.

Sumitomo Mitsui Banking Corporation, Canada Branch

222 Bay Street, Suite 1400, P.O. Box 172

Toronto, Ontario M5K 1H6, Canada

Main Tel: 416-368-4766

Fax: 416-367-3565

Email: smbccatoqueries@smbcgroup.com

3. SMBC Leasing and Finance, Inc.

SMBC Leasing and Finance, Inc., Corporate Structure

SMBC Leasing and Finance, Inc., is incorporated in the state of Delaware, USA, with a London Branch registered in England and Wales. SMBC Americas Holdings, Inc., a Delaware corporation (“SMBCAH”) directly owns 100% of the voting shares of SMBC Leasing and Finance, Inc.

SMBCAH is a wholly-owned subsidiary of Sumitomo Mitsui Banking Corporation, a Japanese banking institution (“SMBC”), and SMBC is in turn a wholly-owned subsidiary of Sumitomo Mitsui Financial Group, a financial services conglomerate that is also incorporated in Japan.

SMBC Leasing and Finance, Inc., Business

SMBC Leasing and Finance, Inc., purchased its UK based subsidiary, SMBC Leasing (UK) Ltd., from SMBC Leasing Company Limited (Japan) on June 22, 2006. SMBCLF and its subsidiaries are engaged in the leasing of personal or real property, or acting as agent, broker or adviser in leasing of such property, in net, full-payout leasing transactions and making, acquiring or servicing loans and other extensions of credit such as would be made by a commercial finance company of the kind permitted for bank holding companies under the US Bank Holding Company Act and Regulation Y of the United States Federal Reserve System.

Slavery and Human Trafficking Statement

Modern Slavery Act 2015 of the United Kingdom

Background

The Modern Slavery Act 2015 (the “Act”) of the United Kingdom requires certain businesses to provide disclosure concerning their efforts to address the issues of Slavery and Human Trafficking in their supply chain. The disclosure is intended to provide customers the ability to make better, more informed choices about the products and services they buy and the companies they support, and has been prepared in accordance with the UK Home Office statutory guidance1 on complying with Section 54 of the Act.

This document comprises the Slavery and Human Trafficking Statement of SMBC Leasing and Finance, Inc. (“SMBCLF”), its London Branch and its UK subsidiaries (collectively, “SMBCLF-UK”) for the financial year ended 31 December 2020.

SMBCLF-UK's stance on Slavery and Human Trafficking

As part of SMFG, SMBCLF adheres to the group commitments to Corporate Social Responsibility (CSR), and the SMFG Statement on Human Rights, which reiterates the ethical responsibility to help protect and promote human rights.

SMBCLF-UK is committed to maintaining and improving systems and processes to mitigate the risk that it might be involved, wittingly or unwittingly, in the commission or facilitation of Slavery and Human Trafficking in any part of its operations, supply chain (including customers, contractors and suppliers), products, services and staff activities. SMBCLF-UK is committed to maintaining and improving systems and processes to mitigate the risk that it might be involved, wittingly or unwittingly, in the commission or facilitation of Slavery and Human Trafficking in any part of its operations, supply chain (including customers, contractors and suppliers), products, services and staff activities.

SMBCLF-UK also expects its staff, suppliers and business partners to adhere to the same high standards and to take reasonable steps to ensure that other third parties they do business with adhere to those standards as well.

Governance

SMBCLF-UK adheres to the Anti-Slavery and Human Trafficking Policy and Procedures of SMBC’s EMEA (Europe, the Middle East and Africa) Division. These policies and procedures provide appropriate and detailed guidance to SMBCLF-UK's staff on what constitutes an offence and the controls in place to mitigate the risk that SMBCLF-UK may be directly or indirectly involved in the commission or facilitation of Slavery and Human Trafficking.

SMBCLF-UK also adheres to SMBC EMEA Division’s Financial Crime governance framework, which includes an Antimoney Laundering/Combating of Terrorist Financing (AML/CTF) Policy, Anti-Bribery and Corruption (ABC) Policy, AntiFraud Policy, and Gifts and Entertainment (G&E) Policy. The Anti-Slavery and Human Trafficking Policy is aligned to, and is supported by, these policies.

Risk Assessment

The SMBC EMEA Division has enhanced its risk assessment of countries, industry sectors, goods and products, which have been reported to be involved in the potential commission or facilitation of slavery and human trafficking. Specifically, the assessment of goods and industry sectors has been updated in line with the United States Department of Labor – Bureau of International Labor Affairs (ILAB) list of goods produced by child labour or forced labour.

Due Diligence

SMBCLF-UK is required to conduct appropriate checks in order to obtain reasonable assurance that customers, business partners, suppliers, and other third parties are not involved in the commission or facilitation of Slavery and Human Trafficking.

SMBCLF-UK requires specific anti-slavery due diligence to be undertaken on all its counterparties, and applies consistent due diligence measures for Slavery and Human Trafficking, whereby suppliers, contractors, customers and any other business partners are all subject to the same level of identification, verification, and risk evaluation. In addition, in the course of conducting due diligence processes, all customers, business partners, suppliers and other third parties are subject to adverse news screening, incorporating specific terms relevant to Slavery and Human Trafficking.

Supply Chain

SMBCLF-UK expects its suppliers to undertake ethical business practices, particularly in, but not limited to, economic sectors where there are higher risks of Slavery and Human Trafficking. SMBCLF-UK takes appropriate steps to verify, evaluate and mitigate the risk that Slavery and Human Trafficking may occur in its supply chain. In particular, SMBCLFUK performs due diligence on suppliers and contractors at the start of a business relationship and subsequently on a periodic basis. This due diligence process includes, but is not limited to, an analysis of the activity carried out by the suppliers and contractors and a detailed review of publicly available information, in order to identify instances that may give SMBCLF-UK cause for concern.

Customers

SMBCLF expects its customers to undertake ethical business practices, particularly in, but not limited to, economic sectors where there are higher risks of Slavery and Human Trafficking. SMBCLF-UK takes appropriate steps to verify, evaluate and mitigate the risk that their products or services may be used by a customer for the commission or facilitation of Slavery and Human Trafficking.

As part of its on-boarding and periodic customer due diligence processes, SMBCLF-UK performs a series of checks on its customers, including, but not limited to, an analysis of the activity carried out by the customers and a detailed review of publicly available information, in order to identify instances that may give cause for concern.

Staff

In order to ensure proper understanding of the risks posed by Slavery and Human Trafficking in the context of SMBCLFUK’s supply chains and business, SMBCLF-UK's staff responsible for the above areas have received training on Slavery and Human Trafficking and the requirements of the Act.

All staff are encouraged to report any instances of suspected Slavery and Human Trafficking identified in any part of SMBCLF-UK’s business activities, either through their standard reporting lines, or through the whistleblowing programme of SMBC’s EMEA Division that is also available to SMBCLF-UK.

Slavery and Human Trafficking

As used in this Statement, the term “Slavery and Human Trafficking” refers to a variety of offences, including but not limited to:

- Slavery, servitude and forced or compulsory labour;

- Sexual exploitation, including all offences contemplated in the Part 1 of the UK Sexual Offences Act 2003;

- Removal and trafficking of organs outside the context of authorised health treatments;

- Securing services or other type of benefits by force, threats or deception; and

- Securing services or other type of benefits from children and vulnerable persons.

Contact

Questions, comments and requests regarding this Statement are welcomed and should be addressed. leaseadmin@gb.smbcgroup.com

Approval

This Statement was approved by the Board of Directors of SMBCLF on September 14, 2021 and has been signed on behalf of the Board by Mr. Stephen Perry, President of SMBC Leasing and Finance, Inc.

Modern Slavery Statement in accordance with the Modern Slavery Act 2018, Commonwealth of Australia

1. Introduction

This statement summaries the current approach to modern slavery of SMBC Leasing and Finance, Inc. (SMBC-LF) and outlines the actions that we have taken to mitigate the risk that human trafficking and modern slavery are not taking place in our business or our supply chains. It is also intended to assist customers to make better, more informed choices about the products and services they buy and the companies they support.

This statement has been prepared by SMBC-LF as the reporting entity in accordance with the UK Home Office statutory guidance 1 on complying with Section 54 of the 2015 Act and Modern Slavery Act 2018 (Commonwealth of Australia).

Both Acts require SMBC-LF to provide disclosure concerning its efforts to assess and address the risks that modern slavery practices may be occurring in its operations and supply chain of any entities that it owns or controls.

2. SMBC-LF’s structure, operations and supply chains

SMBC-LF’s company structure

SMBC-LF is an international leasing and finance company incorporated in the State of Delaware, USA.

Sumitomo Mitsui Financial Group, Inc.

SMBC-LF is a wholly-owned indirect subsidiary of Sumitomo Mitsui Financial Group, Inc. (SMFG) and is part of the SMFG group of companies (SMFG, together with its subsidiaries and affiliates are referred to as “SMBC Group”). SMFG is a publicly listed company. SMFG’s common shares are listed on the first section of the Tokyo Stock Exchange and the Nagoya Stock Exchange. SMFG’s American Depositary Receipts are also listed on the New York Stock Exchange.

SMBC Group is a global financial group that develops operations in a wide range of fields including banking, leasing, securities, credit cards and consumer finance. SMBC Group is comprised of four business units: the Retail Business Unit, the Wholesale Business Unit, the Global Banking Business Unit and the Global Markets Business Unit.

SMBC Group’s overseas network currently is comprised of offices in more than 40 countries and regions. As at 31 March 2022, SMBC Group had approximately 101,023 employees.

Further information on SMBC Group’s business can be found in SMFG's annual report and financial statements, which can be accessed at: https://www.smfg.co.jp/english/.

SMBC-LF operations

SMBC-LF specializes in originating, structuring, arranging and investing in structured assetbased, tax efficient and accounting driven financings in the US and worldwide.

SMBC-LF has offices in two (2) countries with approximately 20 employees. SMBC-LF has operations in Australia and the United States of America. As a subsidiary of Sumitomo Mitsui Banking Corporation (“SMBC”), SMBC-LF supports an extensive global network of SMBC group entities which SMBC either owns or controls. These group entities operate throughout these regions providing the financial services and credit related businesses to SMBC’s global network of customers. Further information on SMBC’s business, including a list of SMBC’s principal domestic subsidiaries, principal overseas subsidiaries and principal affiliates and a summary of the main businesses of these companies can be found here:

https://www.smbc.co.jp/global/aboutus/business; and

https://www.smbc.co.jp/global/aboutus/profile/group/

SMBC-LF in Australia

SMBC-LF established its presence in Australia in 2014 through its branch (ARBN 602 309 366) in Sydney, New South Wales.

SMBC-LF’s Australian operations are based in Sydney, New South Wales. SMBC-LF’s registered office in Australia is Level 40, The Chifley Tower, 2 Chifley Square, Sydney, New South Wales Australia.

In Australia, SMBC-LF provides financial advisory, lease financing, receivable purchases and asset backed debt financing for wholesale customers only. The Australian operations form part of the International Business Unit of SMBC Group.

Further information on SMBC’s global and Australian businesses can be accessed at: https://www.smbc.co.jp/global/; and https://www.smbc.co.jp/asia/australia/.

SMBC’s supply chains

SMBC’s business is primarily undertaken in an office environment with the majority of its suppliers providing goods and services in connection with office premises (such as stationery supplies, cleaning services and food and refreshments supplies), financial, technology and other professional services and corporate travel.

Given its geographic spread, SMBC’s supply chain is geographically diverse with suppliers from countries in which SMBC has operations.

SMBC’s suppliers range from small businesses to international organisations, operating across the developed and developing regions in which SMBC has operations.

Further, SMBC is connected with many thousands more organisations across the world via the supply chains of its first tier suppliers.

By way of example, the main categories of suppliers and service providers (by aggregate dollar value for the financial year ending 31 March 2022) for SMBC Sydney Branch relate to information technology equipment and software; rent; information services; market research; hospitality (including business travel); telecommunications; and professional advisers.

The arrangements SMBC Sydney Branch has with its suppliers are combination of long- term relationships with large multinational suppliers established and maintained as part of SMBC’s global operations and short-term relationships with smaller local suppliers. This list is broadly reflective of the categories of suppliers and service providers of SMBC globally and the entities which it owns or controls.

3. SMBC-LF and SMBC’s risks of modern slavery practices in operations and supply chains

SMBC-LF uses the technology, policies and procedures provided by SMBC to identify and capture risks associated with modern slavery.

SMBC conducts business internationally with operations spanning developed and developing countries and regions. Given the breadth of these operations, there is a potential risk that elements of the supply chain are engaging in modern slavery practices, particularly parts of the supply chain relating to the supply of goods and services. The risk is increased in relation to suppliers to SMBC’s operations in developing countries and regions.

SMBC’s supply chain includes a number of products that have been linked with modern slavery. For example, according to the Global Slavery Index 2018, the number 1 product category at risk of modern slavery imported into G20 countries (by US$ value) are laptops, computers and mobile phones. SMBC’s operations rely heavily on the use of laptops, computers and mobile phones. Using the Global Slavery Index 2018 as a source, SMBC has identified Information Technology services and software, manufacturing, agriculture, construction, mining, trade and service industries (such as hospitality and cleaning) as high risk sectors for modern slavery. SMBC operates in the banking and financial services industry and primarily within an office environment and therefore it does not operate in these sectors.

While SMBC aims to mitigate the risk that its suppliers are directly engaged in modern slavery, there is also a risk that suppliers have modern slavery risks in their own supply chains.

SMBC-LF outsources certain functions to SMBC and third party service providers. For example, SMBC-LF engages various third parties to provide services, such as information technology systems development and document archiving. There is a risk that such providers have modern slavery risks within their operations and supply chain, particularly given that most of these services are heavily reliant on IT hardware and software. These entities are assessed for their approach to managing modern slavery risk. SMBC continues its review of its modern slavery supply chain risk. It continues to consult with the group entities within its operational control. Given that such entities operate in the same financial services industry as SMBC, it believes that the modern slavery risks in its operations and supply chains is representative of the risks in the operations and supply chains of such group entities.

It is also acknowledged that modern slavery risks can also arise through the operations and actions of SMBC-LF’s customers. SMBC, therefore, may be linked to such risks, as a provider of financial services. Again, where these customers operate within jurisdictions or sectors with a high risk of modern slavery, this risk is heightened.

4. SMBC-LF and SMBC’s actions to assess and address risks of modern slavery practices

(1) SMBC’s commitment and policies in relation to slavery and human trafficking

SMBC is committed to maintaining and improving systems and processes to mitigate the risk that it might be involved, wittingly or unwittingly, in the commission or facilitation of Slavery and Human Trafficking in any part of its operations, customers and supply chain (including contractors and suppliers), products, services and staff activities.

As a signatory to the United Nations Global Compact, the SMBC Group is also committed to fulfilling the social responsibilities that are expected of it as a global financial group to create a society that is built on the utmost respect for human rights as directed by the "Universal Declaration of Human Rights," the "ILO Declaration on Fundamental Principles and Rights at Work," the "ISO 26000" guidelines on the social responsibilities of organisations, and the "Guiding Principles on Business and Human Rights" advocated by the UN Human Rights Council in 2011.

a. Initiatives for Sustainability

SMBC Group has positioned the sustainable development of society as a key issue and in October 2018, the establishment of its Corporate Sustainability Committee enables SMBC Group to better carry out the group’s Corporate Social Responsibility (CSR) and Environmental, Social and Governance (ESG) commitments.

In addition, SMBC Group has established the “SMBC Group environmental and Social Framework” in FY2021 in order to unify its internal policies on and approach to environmental and social issues.

This framework clarifies the Group’s approach to climate change, natural capital, respect for human rights, and social contribution based on the “SMBC Group Statement on Sustainability”, which states the Group’s basic stance toward realizing a sustainable society, The Group’s governance system for ESG risks is organized under this framework, including due diligence and policies related to each sector and business.

SMBC Group also formulated policies for specific businesses and sectors which are likely to have significant impacts on the environment and society. During FY2021, in the perspective of environment and respecting human rights, we decided to revise our policy for coal mining to not support newly planned and the expansion of thermal coal mining projects, as well as newly planned and the expansion of infrastructure developments that are dedicated to such projects

Further information on SMBC Group’s commitment to sustainability and policies for specific business and sectors can be found here:

https://www.smfg.co.jp/english/sustainability/group_sustainability/esframework/

b. SMBC Group’s statement on human rights

During FY2020, SMBC Group enhanced its Statement on Human Rights, which recognises the ethical responsibility of the SMBC Group to support and respect the protection of internationally proclaimed human rights and to prevent complicity on human rights violations. As noted in its statement, through dialogue and collaboration with stakeholders, SMBC Group aims to eliminate all forms of exploitative labor practices in its business and supply chains, including modern slavery, forced labor, human trafficking and child labor.

Further information on SMBC Group Policy Statement on Human Rights can be accessed at:

c. Principles of Action on Compliance and Risk

SMBC Group has established the “Principles of Action on Compliance and Risk”, which is a fundamental guidance from a compliance and risk perspective, on how SMBC group employees should act, in accordance with our Group Mission, Vision and Values.

The “Principles of Action on Compliance and Risk” require that SMBC Group employees respect human rights and embody these principles through its business, in order for SMBC group to realise the sustainable growth of its corporate values.

Further information on SMBC group’s Principles of Action on Compliance and Risk can be accessed at:

d. Sustainable Procurement Policy

SMBC Group published the “Sustainable Procurement Policy” on April 1st, 2022, in order to strengthen responsible procurement activities that carefully considers the environment and society throughout its supply chain.

This policy is based on the 10 principles of the United Nations Global Compact, the OECD Guidelines for multinational enterprises, the United Nations Guiding Principles on Business and Human Rights, and other international principles.

SMBC Group’s procurement activities are carried out in accordance with fair, impartial and transparent procedures based on free competition, which is in line with this policy and other relevant laws and regulations.

Further information on SMBC Group Sustainable Procurement Policy can be accessed at:

https://www.smfg.co.jp/english/sustainability/group_sustainability/pdf/stakeholder_policy_e.pdf

e. Anti-Slavery Policy

An Anti-Slavery Policy has been implemented within SMBC London Branch, which sets out the processes through which it seeks reasonable assurance that none of its customers, business partners, suppliers and other third parties are involved in the commission or facilitation of Slavery and/or Human Trafficking.

The Anti-Slavery Policy is supplemented by procedures and detailed guidance on what constitutes an offence and the controls in place to mitigate the risk that the branch may be directly or indirectly involved in the commission or facilitation of Slavery and/or Human Trafficking.

(2) SMBC’s actions in connection with its workplace environment, customer and supplier

SMBC is committed to prevent and remediate modern slavery risks by taking the following steps and actions.

a. Workplace

SMBC-LF seeks to provide a workplace free from any type of violation of employees' human rights, including but not limited to, forced labour, harassment and discrimination without distinction of any kind such as race, gender, sexual orientation, gender identity, religion, creed, national origin, disability, family status and birth status. This is reflected in SMBC Group’s numerous public statements on its commitment to protecting human rights as well as its employee codes of conduct and policy and procedure manuals in operation across its global network.

SMBC Group has systems in place (grievance mechanisms) through which various stakeholders can raise human rights issues associated with its business. Customers can contact SMBC Group through the call center, telephone, and website. Employees can raise their concerns via dedicated internal whistle-blowing channels.

Members of staff are encouraged to report any instances of suspected Slavery and Human Trafficking identified in any part of SMBC’s business activities. The options for raising concerns and reporting are incorporated within SMBC’s whistleblowing program.

b. Customer

The credit policy of SMBC Group prohibits granting credit to certain businesses and customers, which includes those who exhibit unacceptable practices from the perspective of public order and morals.

There is a prohibition on the origination of loans for certain types of businesses where human rights abuses, such as child labour is, or may, be taking place or is likely to take place.

SMBC has established its own internal procedures and has completed the Procedures for Environmental and Social Risk Assessment (the "Procedures"). The Procedures set the internal policy and procedures for environmental and social risk assessment, taking into consideration various factors, including the Equator Principles, and they have been implemented since June 2006, and amended from time to time.

An Independent Assurance Report was issued by Ernst & Young ShinNihon LLC on 1 June 2020, wherein no adverse finding or non-compliance had been noted.

Furthermore, in accordance with the SMBC AML/CFT Global Procedures, SMBC-LF conducts due diligence on its customers at both the on-boarding stage and at regular periods thereafter, as part of its anti-money laundering compliance responsibilities.

In SMBC-LF the due diligence includes compliance specific database searches on customers in relation to adverse news, which would identify news in connection with sanctions and human rights violations. This also includes ongoing screening in respect of customers, customer associated parties and trade finance transactions for connections to jurisdictions with human rights issues.

Furthermore, SMBC established human rights working group in FY2021, which includes various corporate departments, to discuss and introduce efficient measures to prevent human rights abuse. As a result, SMBC is planning to introduce a new set of measures concerning human rights due diligence on clients and projects that SMBC provides loans to, in order to identify and assess the risks concerning modern slavery. In addition, we also introduced enhanced due diligence for clients operating in a sector that is considered high risk from a modern slavery or human trafficking perspective.

c. Supply Chain

SMBC takes appropriate steps to verify, evaluate and mitigate the risk that Slavery and Human Trafficking may occur in its supply chain.

In Japan, SMBC has established Outsourcing Management Procedures, which require every office to perform due diligence on third parties in relation to Slavery and Human Trafficking by reviewing publicly available information.

In FY2020, the SMBC Group Outsourcing Due Diligence Program was enhanced to ensure an assessment and monitoring of all vendors/service providers (regardless of whether the service is considered to be outsourcing) is undertaken at least annually. The three areas of focus include the Japanese Anti-Social Forces Screening, Anti-Bribery and Corruption Due Diligence and Modern Slavery Due Diligence.

SMBC has also established Outsourcing Management Procedures for Overseas Offices, which stipulates that overseas offices should conduct appropriate due diligence in relation to Slavery and Human Trafficking. This due diligence process includes reviewing publicly available information such as the third party’s or its parent company’s website in respect of its policies or positions on the protection of human rights, as well as internet searches to determine whether there is any adverse news in respect of human rights violations. Per SMBC Group policy, contracting with a third party is prohibited if the third party is engaged / involved in human rights violations. Results of the assessments for all SMBC offices are consolidated and reported as part of the SMBC Risk Management program. SMBC Australia engaged a third party global compliance and due diligence company that specialises in third party due diligence and management. For the next financial year, the top 20 vendors by annual aggregate expenses engaged by SMBC Australia will be requested to answer a series of questions through an online platform that has been tailored for SMBC Australia, which will assist SMBC Australia to assess the modern slavery risk within its supply chain and enable it to focus its efforts on any high-risk suppliers. SMBC London requires specific anti-slavery due diligence to be undertaken on all its counterparties, and applies consistent due diligence measures for Slavery and Human Trafficking, whereby suppliers, contractors, customers and any other business partners are all subject to the same level of identification, verification, and risk evaluation.

As part of the on-boarding and periodic due diligence processes in SMBC London Branch, all counterparties are assessed to determine if they fall within the scope of the Act, and, if so, a copy of their Anti-Slavery Statement is sought and retained. By way of best practice, for those counterparties who are not in scope of the Act, SMBC London Branch will seek to obtain an equivalent policy or document relating to CSR, ESG or Human Rights.

5. SMBC’s methods to assess effectiveness of actions

Modern slavery has been introduced in the SMBC Group global compliance risk assessment framework.

Consistent with the SMBC Group global compliance risk assessment program, effectiveness is determined on an assessment as to:

- appropriate design of relevant policies and procedures to ensure compliance and risk management;

- how well the control processes have operated, including timeliness and comprehensiveness;

- the extent of employee training that has been conducted;

- the outcomes from monitoring and validation procedures; and

- the timeliness of remedial action taken for any issues arising.

Enhancements may be made as considered necessary as a result of these assessments.

6. SMBC’s consultation process with its subsidiaries and other controlled entities

The global compliance risk assessment framework referred to above is a channel for SMBC offices to provide feedback to Head Office through the annual reporting of risk assessment and implementation of control practices to assist in mitigating risks. As well, the enhanced Vendor and Outsourcing review management program provides an additional source of information for SMBC to assess the modern slavery risks associated with its suppliers and outsourced activities.

7. Training

In order to ensure proper understanding of the risks posed by Slavery and Human Trafficking in the context of SMBC’s supply chains and business, SMBC provides training to staff on Slavery and Human Trafficking and the requirements of the Act.

SMBC has provided specific training in relation to modern slavery, incorporating relevant resources and due diligence requirements, as a part of compliance training. At the end of FY2021, nearly 21,000 employees which accounts for most of SMBC employees in Japan, had completed the training.

SMBC Australia is also including modern slavery and human trafficking risks as well as due diligence measures undertaken in its compliance training program.Furthermore, during FY2021, SMBC planned to hold a study session for executives by inviting human rights experts to enhance their understanding of modern slavery, and the study session was conducted in May 2022. SMBC will also continue to provide the training in relation to human rights on regular basis for our employees in order to promote awareness of human rights.

8. Approval

This Statement was approved by the SMBC-LF Board of Directors on 20 December 2022 and has been signed on behalf of the Board by Mr. Stephen R. Perry, President of SMBC-LF.

4. SMBC Nikko Securities America, Inc.

Anti-Money Laundering

Summary of Anti-Money Laundering (AML) Related Information and Company Status with Regulators

SMBC Nikko is a registered broker-dealer with the SEC and a member of the self-regulatory organizations, FINRA and MSRB. As such, SMBC Nikko is considered a "covered financial institution" for purposes of the U.S. Bank Secrecy Act, as amended by the USA PATRIOT Act and is subject to the regulations thereunder, as well as the rules and oversight of the federal regulatory agencies and self-regulatory organizations listed above.

Our policy is to prohibit and actively prevent money laundering and any activity that facilitates money laundering or the funding of terrorist or criminal activities. Money laundering generally is defined as engaging in acts designed to conceal or disguise the true origins of criminally derived proceeds so that the unlawful proceeds appear to have been derived from legitimate origins or constitute legitimate assets.

Customer Identification Program

To help the government fight the funding of terrorism and money laundering activities, federal law requires us to obtain, verify and record information that identifies each person or entity who opens an account. When you open an account, we are required to ask for certain identifying information such as your legal name, address, and other information that will allow us to identify you. We also may ask to see identifying documents to verify your identity and to screen your name against various government databases.

Notice Regarding Entities Identified as Being of Primary Money Laundering Concern

Pursuant to U.S. regulations issued under section 311 of the USA PATRIOT Act, 31 CFR 103.192, we are prohibited from opening or maintaining a correspondent account for, or on behalf of, certain Specified Banks. The regulations also require us to notify you that your correspondent account (if applicable) with our financial institution may not be used to provide the Specified Banks with access to our financial institution. If we become aware that the Specified Banks are indirectly using the correspondent account (if applicable) you hold at our financial institution, we will be required to take appropriate steps to prevent such access, including terminating your account.

Business Continuity Plan

Sumitomo Mitsui Banking Corporation ("SMBC”) is committed to maintain a duty of care as to our staff, protect our and our customers’ assets and information, and minimize financial, legal/regulatory, and reputational impact in the event of an operational disruption, major internal or external incident, or crisis event.

In furtherance of this commitment, SMBC maintains a comprehensive Business Continuity Management Program (the “Program”) to provide appropriate resilience and recovery for critical business processes, systems, and data as needed.

The Program is derived from and adheres to a number of regulatory, governmental, and industry standards and guidelines, including, without limitation:

FINRA Rule 4370 (General BC Requirements);

NYSE IM 05-80 (General BC Requirements);

CFTC Rule 23.603 (Business Continuity and Disaster Recovery);

NFA Rule 2-38 (General BC Requirements);

FFIEC Exam Handbook (IT BC Requirements);

US Treasury 2008 Strategic Plan (Treasury Auction OOR Requirements);

FRB SR Letters (including 03-09 – Sound practices and 13-19 – Outsourced risk);

and related regulations, standards, and guidelines in Brazil, Canada, Latam, and the Cayman Islands.

The Program is regularly audited internally and externally and SMBC actively engages with industry groups regarding resiliency within the financial sector to stay abreast of any developments and ensure our Program is adequate.

The Program includes:

- Crisis management plans to manage critical functions during and following any significant business disruption;>

- Documented procedures to back-up and recover critical systems and data; and

- Communication plans for key stakeholders, including clients, employees, partners, and vendors.

SMBC has a dedicated team of business continuity professionals whose job is to ensure that Program is documented, reviewed, and tested in line with all applicable standards.

The Program is supported by the Board of Directors and governance committees

Should you have any specific questions about our Program, we encourage you to bring those to your SMBC Relationship Manager.

Securities Exchange Act Rules 606 and 607

Securities Exchange Act Rule 606 - Routing Statistics

SMBC Nikko publishes quarterly reports pursuant to SEC Rule 606(a) broken down by calendar month, containing certain required statistical information regarding the routing of held, non-directed customer orders in Regulation NMS stocks and listed options in NMS securities, including the nature of any relationship SMBC Nikko has with each venue. In addition, customers of the firm may request in writing details on NMS stock and option non-directed orders in NMS securities including the identity of the venue and the time of execution for the prior six months as required under Rule 606 (b)(1). SMBC Nikko is required to provide under certain circumstances additional routing and execution reports of the customer’s NMS stock orders submitted on a not held basis for the prior six months under Rule 606 (b)(3) within seven days of customer’s request.

To obtain a copy of our publicly disclosed SEC Rule 606 Report, visit IHS Markit website at https://mta.ihsmarkit.com/app-v2/public-report-library/public-report-library-view/SMBC%20Nikko%20Securities%20Americas%20Inc/213.

To obtain a copy of our publicly disclosed SEC Rule 606 Report prior to 2020, visit IHS Markit website at https://vrs.vista-one-solutions.com/sec606rule.aspx?clientid=sumi.

Securities Exchange Act Rule 607 - Disclosure of Payment for Order Flow